You know I’m all about using my “cents” to live a fabulous life. As I get older, however, I’m feel empowered to define and redefine what a fab life looks and feels to me. One thing that is classic and has always made me feel… well fabulous is fresh flowers at home. It’s something about them that makes me feel very adult and chic, which inspires me to get my house super neat and clean as if Elle Décor was coming through. Being in the event design industry, I am fortunate to see all sorts of beautiful floral from around the world. Being on a financial plan, though, means that it is imperative to find creative yet economical ways to make sure that a simple luxury like fresh flowers is in the budget. Check out what could be one of my new go-to stops for fresh flowers on a budget.

The Bouqs

The Bouqs is a company out of California who contacted me last month about reviewing their product. Prior to that, I had not heard of them (I guess I missed that episode of Shark Tank). After doing a little digging, I learned that they offer sustainable and eco-friendly flowers that are grown on an active volcano in South America. Have you ever had volcano flowers??? Yeah, neither had I, so I had to order a bouq (short for bouquet) and let you all know if this is worth adding to your “simple luxuries” money envelope. I went to their website and I was immediately impressed that they had Ranunculus at a time when my floral distributor could not even get them for my brides at work. Swoon-worthy right?

While I LOVE ranunculus, I wanted something with a little flirty touch, so I took a chance and ordered their Desperado bouquet. As seen below, the Desperado is comprised of a lovely composition of pink roses and soft purple Dianthus. I thought the colors were gorgeous so I pressed “order” and waited a week. The delivery came as scheduled, but to my surprise, my pink and purple bouquet was all pink. It was not a big problem, but it just wasn’t what I expected… until I looked online and saw the note that stated: “Pink Roses with Purple Dianthus or similar accent flowers“. This folks, is a prime example of why it is important to read to the end of the line and the bottom of the page J.

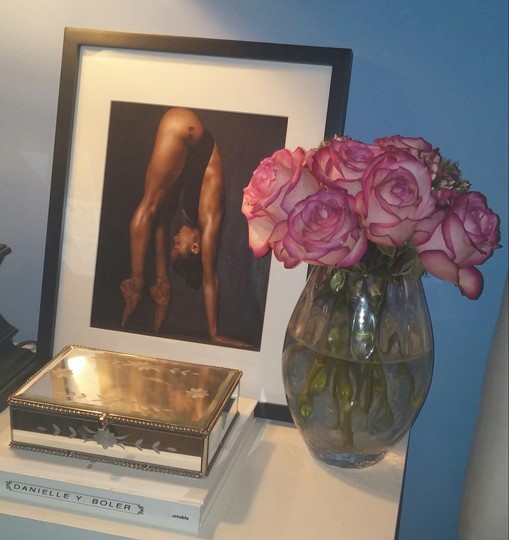

Being that I had these delivered to my office, I had a slew of vases in our floral department to choose from. They arrived in a box so I immediately cut them under water at a slight angle to help them last longer. I also was advised by one of our senior designers at my office to remove all extra leaves and cut them short so that water and flower food is not wasted on foliage. I mixed in the flower food that was provided and started playing with how I wanted to style the arrangement I was making. This was my first arrangement right after I took it out of the box on day one.

Day Three

A Week Later

Bouqs start at $40.00 an order, including shipping, and would be a great option for birthdays, anniversaries, holidays, dinner parties or just because. It’s not in my financial plan to get these weekly, but I will definitely take advantage of their concierge service that allows you to schedule floral deliveries to your favorite people. I know I will also use them again because the quality, service, and ability to stay fresh longer than your grocery store flowers makes it worth the money. I will list this as: A GOOD BUY.

What’s Your Take on Fresh Flowers? Fab or a Waste of Money

FACEBOOK, TWITTER, PINTEREST, RSS Feed,

Email SMC: shemakescents@gmail.com

As a millennial woman, I know many of my peers shy away from conversations about money and becoming financially fit for fear of looking dumb for not knowing the basics. Financial terms are spoken and we hear Charlie Brown’s teacher and stop listening. I want to help break down self-imposed barriers that could be keeping us from confidently making smart money moves. In an interview for Mint, I was asked off the record if I thought that women view money management differently than men. While some people believe women are not confident in making big financial decisions, I’m inclined to disagree.

As a millennial woman, I know many of my peers shy away from conversations about money and becoming financially fit for fear of looking dumb for not knowing the basics. Financial terms are spoken and we hear Charlie Brown’s teacher and stop listening. I want to help break down self-imposed barriers that could be keeping us from confidently making smart money moves. In an interview for Mint, I was asked off the record if I thought that women view money management differently than men. While some people believe women are not confident in making big financial decisions, I’m inclined to disagree.

I

I

Would you spend $50.00 for nail polish?

Would you spend $50.00 for nail polish?