Words cannot express my excitement over the 2012 holiday collaboration between retailers Neiman Marcus and Target which will launch on December 1st (for more information, click here)! Based off the amount of views I got when I first announced the collaboration, I know I am not alone in my excitement. This is the ultimate shopping opportunity to use your “cents” to live the fab life! Click the picture below for a sneak peek of the goodies to come!

Author: Danielle YB Vason

{Looking for Money} Simple Suggestions to Start Saving Money TODAY!

If I walked in a room and asked everyone who is completely debt free to raise their hands and someone did, I would truly be surprised. It’s not because I’m unaware of the fact that debt-free people do exist, it’s just because I see an abundance of people from all walks of life trying to get their finances in a better place. I myself am one of those people. The inspiration for this post comes after sitting down and looking at my finances for this month. A wrench was unexpectedly thrown into my financial pattern when a mistake was made on one of my checks (hey, it sucks but it happens). This caused me to take a closer look at my money. Where is it going and could I save more?

Here’s what I found:

I started the morning trying to pay a bill online that I have already paid. What can I say, at the point in the day, I hadn’t gotten my Starbucks fix. Once on the site, though I saw something about saving money with a FREE online Energy Audit from GA Power, so I followed the link. It took less than 10 minutes and it showed me how the changes I have made over the past year have saved me money in a monthly comparison of 2011 to 2012. It also provided some suggestions for home improvements that can increase comfort while lowering monthly bills. According to Energy Star, “a home energy audit is often the first step in making your home more efficient. An audit can help you assess how much energy your home uses and evaluate what measures you can take to improve efficiency.”

After the Energy Audit, I checked out my credit card balance (insert sad face). Just to give a little background, a few years ago I paid off my credit card by paying a set amount ($200 a month) instead of the minimum payment. During that time, I saw the decrease in the balance move rather quickly. Now, after living off of my credit card for one year + span of not working, then a complete career change with a different kind of salary, my credit card balance hit an all time high. I’ve been working to pay it and the balance is moving in the right direction, but it’s not moving fast enough. So, I decided to input my information into a credit card payment calculator to find out the timeframe of being credit card debt free. I added a credit card calculator on the right panel of SMC, but I really like this one from the Consumer’s Alliance because it reveals just how much that credit card is going to cost you, or how you can pay off your existing credit card debt a bit faster. Now, i have an exact goal date and I understand better how a few dollars can make a big difference in the end.

Lets Connect!

Email SMC: shemakescents@gmail.com

{September Update} Confessions of New Year’s Resolutions

This post is dedicated to Audrey at Just Add Paris…hey girlie! Back in April, I posted an update to my New Year’s Resolutions. As we approach the final leg of 2012, I thought I owed Ashley an update since she asked me to write one over a month ago. So…here goes:

Start Putting Money Away for Emergencies

January 24, 2012: Since I’m being honest, I might as well go all in. Currently, my emergency fund looks like the sad little piggy pictured here. That’s right, even She Makes Cents, has to get her own finances together sometimes. I almost depleted my fund when… an emergency came up. I am so glad that I got myself into the habit of saving for the unexpected because life would have been so much harder without one.

April 4, 2012: I have started my emergency fund again and I must say it feels good. I really hope it will be a long time before I have to tap into it since there isn’t much in there and two, no one likes emergencies.

September 30, 2012: I’m still going strong putting away money into my emergency fundJ How are you doing with your emergency fund?

Cook More, Eat Out Less

January 24, 2012: The Mr. and I love trying new restaurant spots; consequently, we have gotten in the habit of going to restaurants multiple times a week. Sometimes, I even eat out multiple times a day. While examining our finances, we both concluded that we can’t save if we are constantly spending on dinners out every night, plus tips for the servers, plus parking. Do you see how quickly it can add up? Not only are we spending too much, but also it is counteracting to my bangin’ body goal.

April 4, 2012: Well…we still eat out, but we are now more conscious of it. Using the envelope system has really helped with this one. I set aside a certain amount of money per check for non-grocery food expenses. For example, I stopped at Smoothie King this morning for a Pineapple Surf and used my “restaurant fund” to essentially…fund it. The envelope system, regarding eating out, has also forced me to really think about my motivation. Am I really hungry? Am I going to be social? Now, I need to work on the “cook more” portion of this resolution.

September 30, 2012: We are still working on it. I have actually set a new goal for myself to eat at least 10 home cooked meals a week. I might actually like cooking a little more. Did I mention that I made my first lasagna from scratch?

Bangin’ Body 2012

January 24, 2012: I think this one is a little self-explanatory. I will just let these swimsuits be my inspiration. I say show it while you got it…so I have to get mine tight. Get it right, get it tight 2012!!!

April 4 2012: I am pleased to announce that I am actually starting to see a difference in my tummy. I started jogging, stretching, and taking the dog out for longer walks. I am also trying to eat a little better, so once swimsuit season officially begins; I hope to have accomplished my goal of losing 2 to 3 inches. As of yesterday, I’m already down an inch.

September 30, 2012: I actually just started “The World’s Fastest Workout” and let me tell you it is NO JOKE! I now have a goal to be healthy first and then the bangin’ body will follow.

Reduce Impulse Shopping

September 30, 2012: I am finding that my urge to impulse shop has significantly reduced. I am happy about it and trust me, so is my wallet!

See the World

April 4 2012: So my Dad and I are getting our passports updated this week. This is very necessary since I will be celebrating the Mr.’s 30th birthday in Germany among other places. Overall, I would say that I’m not too far off of my goals for 2012. While I could be doing better in some areas, I could also be doing A LOT worse. In fact, as I accomplish my goals, I will start replacing them with new goals.

September 30, 2012: I got my passport and I am back from Germany and Czech Republic. This was both of our first international trips and we are already planning the next one. It was an AMAZING experience and now I want to see more of the world. We toured castles and beautiful Cathedrals, kissed under the fake Eiffel Tower, shopped, tried foods, celebrated the Mr.’s Dirty Thirty in style! I even found a TK Maxx over there, which was their version of TJ Maxx! Yep, I was shopping smart even 4,000 miles away.

Let’s Connect!

FOLLOW: FACEBOOK, TWITTER, RSS Feed,

Email SMC: shemakescents@gmail.com

inform and inspire ways to use your “cents” to live a fab life

{Super Market Spending Traps} Do You Fall Victim to the Spending Traps?

{Cause We Support} Building Good Self-Esteem in Girls

Imagine a world where beauty is a source of confidence, not anxiety.

Dove® is committed to building positive self-esteem and inspiring all women and girls to reach their fullpotential—but we need your help.They are building a movement in which women everywhere have the tools to take action and inspire each other and the girls in their lives. It could be as simple as sending a word of encouragement to a girl in your life or supporting self-esteem education in your town. From mentoring the next generation to celebrating real beauty in ourselves and others, we can open a world of possibilities for women and girls everywhere.

Click here for more info!

Lets Connect!

Email SMC: shemakescents@gmail.com

{Money Journal} The Pros and Cons to Credit Card Upgrades

On a given week, my mailbox is flooded with credit cards upgrade offers that I immediately place in the recycle bin. It wasn’t until about a month or two ago that I received two separate offers that made me go hmmm…, maybe I should find out more. So off to the bank I went to speak with a representative about the Limitless Card and the Cash Back card.

The Limitless Card

The first offer that intrigued me was one the limitless card, known to me as the Discipline Tester. I sparingly use my card anyway, so a limitless card would actually help boost my credit score because it eliminates the debit to credit ratio for that card. There are several downsides to this type of card, though. For those who are not careful, the limitless factor could entice one to live beyond one’s means; thus, putting the cardholder further into debt. Another disadvantage to this type of card is the higher interest associated with the card… like say around 22%, which would skyrocket even more if you were ever late for a payment. In my opinion, this card is a NO GO!

The Cash Back Card

A cash back credit card is one that offers a percentage spent back to the card holder. It’s great because you can get money back for things you would buy anyway, like gas, groceries, and sometimes travel expenses. It’s also great, because you can have the cash received applied to your credit card bill, into a checking or savings, or in some cases applied to your mortgage. It’s downside- some people get so caught up in the cash rewards that they spend more than they were initially planning on saving. Therefore, you are basically spending money to get a deal…again, NOT GOOD!

Between the two cards, I did choose to upgrade to the cash back card. I found myself briefly falling into the spending trap of the cash rewards card. On a positive note, the cash back rewards seem to be accumulating much faster than the reward points system of my previous card and I will use that money to in turn, pay down my debt. More updates to come as I feel how it is working out.

Questions About Credit Card? Contact Us!

FACEBOOK, TWITTER, PINTEREST, RSS Feed,

Email SMC: shemakescents@gmail.com

{B-day Swag} How To Get Free Stuff on Your Birthday

Calling all Birthday Girls!

As I sit at the computer looking for a birthday dress, I realize that my birthday is right around the corner. But enough about my b-day. I know so many amazing people who are August babies that by the time mine comes around, I am exhausted from the celebrations! This post is for all everyone out there celebrating birthdays, especially those celebrating birthdays today: Kaylah, Nicole, Amanda, Tanika. Last year to the day, I wrote a post about birthday freebies . Now I am here to tell you what actually worked and what didn’t.

My Highest Ranked Birthday Freebie

Hands down- the best freebie I have EVER signed up for is the Chef’s Table from Bennihana! I happily used my $30 gift certificate and enjoyed an amazing evening with one of my really good friends. In addition to the amount of the gift certificate, I can’t help but love that you get an entire month to use it. With my busy work/social schedule, I can sometimes be difficult to try to claim all of the free deals in one day….especially when you should be out painting the town….well PINK!

My Own Epic Fail

I called myself signing up for the birthday club at Moes and for whatever reason, it did not workL. I’m sure this doesn’t seem like a big deal, but I was really looking forward to my FREE burritos (I crave Moes all the time). This year, I will make sure I have a paper copy of my birthday email to show.

Other Companies That Offer Birthday Freebies

- Bath & Body Works

- DSW

- Victoria Secret

- Melting Pot

- Waffle House- don’t judge me, I’m from Atlanta

- Aveda– just signed up today!

- Sephora– just signed up today!

- Starbucks- free coffee (yum)

Tips from the pros

There’s an art to grabbing gratis goodies. Keep these strategies in mind:

- Set up a dedicated email account for birthday swag. Even if a business promises not to sell your info to marketers, it will likely send regular messages about sales and promotions.

- Sign up for multiple offers, then s-t-r-e-t-c-h that celebration by dining or going out for dessert out as many times as you can in your birthday month. It helps to have friends who don’t mind being the buy-one half of the BOGO offers.

- Call to make sure the local store accepts an offer (some franchisees opt out of national promotions).

- Bring your ID and a printout of the offer, and tell the server ahead of time, not after the check has arrived.

- When dining out, base your tip on what you would have paid, not what you actually paid.

- Once your child ages out of the kiddie offers, sign him or her up for the appropriate grownup ones.

- If it’s a “no purchase required” offer, such as a free bath product, don’t feel obligated to buy something. Just say “thank you” and go.

Happy Birthday!

FACEBOOK, TWITTER, PINTEREST, RSS Feed,

Email SMC: shemakescents@gmail.com

{The Green Experiment} How Going Green Can Save You Green

The Green Experiment, have you heard of it? If not, let me be the first to introduce how “going green” with your finances could really save you money. At its most basic level, it is doing away with your debit and credit cards and living off cash for a specified period of time. Did you know that most people spend more when they pay with cards over cash? One psychologically reason for this is that people can’t “see” the money dwindle down when using cards. If you are using the oh so fab, envelope system, you are already living a green life. For others, this experiment might not be as easy as it sounds. For those of you up for the challenge, let’s see how you do for ONE week with cash only. My thoughts… you will start saving money because you can physically see your wad dwindle with every purchase. Hopefully, this will cause you to determine to spend or to save. Sophia Banay from Glamour magazine adds, “all you need to determine whether you can afford something is peek in your wallet.” If you are down for the challenge, She Makes Cents is going green starting Sunday, August 5th.

Are You Down for the Challenge?

FACEBOOK, TWITTER, PINTEREST, RSS Feed,

Email SMC: shemakescents@gmail.com

{Every Woman Should…} Have An Updated Passport

“You don’t have enough stamps in your passport”… (In my Jay-z voice)

I had dinner a couple of weeks ago with a friend (hi Rashell) who mentioned that when she gets the opportunity to speak, one on one, with more seasoned women, she asks them, “if you can do it all over, what would you do differently”? I thought this was a very interesting question that could provide a great life lessons. So, when I got the opportunity to ask the same question to some women I know, I was surprised by one subject that continued to come up- TRAVEL. It made me think of a conversation with someone very close to me who told me that she never thought she would reach this point in her life and never seen the world. Her answer prompted a very simple follow up question from me, why not? Her answer – time and money. This conversation has stuck in my mind since early this year, giving me the extra push to get myself together before I’m looking back thinking shoulda, coulda, woulda, myself. I believe every woman should have a passport whether one has travel plans or not. It’s a first step that provides options to go nearly anywhere in the world and the freedom to do it when you want. Looking back, I am saddened by that particular conversation, but also blessed by the lesson learned. Life is short and while I enjoy making a list of all of the things I want to do while here on Earth, it’s more important to actually start crossing some things off! I got my passport in the mail last week. Number 12 of my bucket list is now crossed off with the plan to have a couple of stamps in it before the start of 2013.

For more information about the passport application and renewal procedures, click here!

Lets Connect!

Email SMC: shemakescents@gmail.com

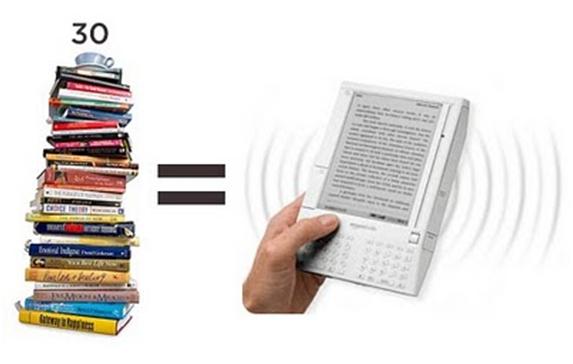

College Students: How to Save Up To 80% on your Textbooks

As an English major at Spelman College, I could easily spend $500 on books for one semester. It all depended on the classes and professors that I put on my schedule. While some classes required one or two major textbooks that cost a fortune, other classes required several books at a time and no you did NOT get the “hookup” if your professor wrote the book (s/o to Dr. Harper at Spelman College and her Langston Hughes class). Did I mention that I took a full load every semester for two and a half year straight, which meant a lot of books?

Rent Textbooks Electronically from. . .

Luckily, the college students of today do not have to worry about that. Today, Amazon.com announced the launch of Kindle Textbook Rental–now students can save up to 80% off textbook list prices by renting from the Kindle Store. Tens of…

View original post 365 more words