In honor of my “Word of the Year“, P-A-S-S-I-O-N, I’d like to share this quote from Sheryl Sandberg, COO of Facebook, author of Lean In, and overall empower-er of girl power in the workplace. I choose the word passion because I resolve to be passionate in my thoughts because thoughts become actions before they become habits. Imagine how divine the year will be once I am consistently and habitually passionate about things that require my time (i.e. financial goals, career, self-improvement,and love)…just to name a few things one can be passionate about. The focus and elevated motivation will help this new year be my best year! #SMCYearofPassion

Author: Danielle YB Vason

{Super Charge Your 2015 Savings} 52 Week Money Challenge | Bingo Style

Can I get a “BINGO”? It’s a new year, which means it is time for the 52 Week Money Challenge. I can tell by looking into my stats for the She Makes Cents that people are researching ways to save money in the new year. I mean really, we can all do something a little different with our financial decisions that will set us up for financial success. For the past two years now, I have taken part in the 52 Week Money Challenge. In participating for the past two years, I created a simpler way to save that was both lucrative and effortless. My She Makes Cents Bingo Style Sheet, free for She Makes Cents readers, has made it easier for those participating in the challenge to save money on one’s own terms. Using my Bingo Style Sheet has helped me to pay off my credit card debt, save for the holidays, and start saving for my wedding in October.

How Does It Work?

The original challenge was to make a weekly deposit that reflects the number of weeks of the year. For example, on week one you deposit $1.00 and on week 27 you deposit $27.00 and so on. However, doing it this way will have you shelling out the big bucks during the holidays when people’s money is the most limited. I thought to myself…”Danielle, how can you find a way to honor the challenge in a way that will not hurt you financially”? Then I came up with the idea to create a “bingo” style format. At the end of the year, I would still end up with the same amount of $1378.00 (without doing any of the bonuses) and if I am having a tough financial week, I can pick a lower amount to save. The good thing about the bingo challenge is that you are able to start at any time and if you get off track, it’s easy to see where you need to make it up to get back on track.

Still Need Motivation?

I will post my progress on Fridays and I invite you to keep us up to date on your progress. I love hearing your stories of how you are doing in the challenge and the financial milestones you have accomplished by making saving a habit of your daily life. Sometimes doing it with a friend or even a blogger like me, keeps you better motivated since you aren’t in it alone. If you have questions, comments, or suggestions, shoot me a line below. Happy Saving!

How Are You Going Use Your $1300+ ?

FACEBOOK, TWITTER, PINTEREST, RSS Feed,

Email SMC: shemakescents@gmail.com

What ONE Word Reflects Your Vision for 2015?

If you could choose one word to reflect your personal goals/resolution/vision for 2015, what word would you choose?

Every year I post this question to my readers on the She Makes Cents Facebook page. The year 2013 was my year of BALANCE, 2014 was my year of FOCUS, and 2015 will be my year of PASSION. Passion is something you can’t fake, it is motivating, and a compelling energy that elevates one’s thoughts and actions to the next level. Welcome 2015 and cheers to a passionate year! I’d love to hear your vision for the New Year. Please share your one word in the comments section below.

What ONE word reflects your vision for 2015?

FACEBOOK, TWITTER, PINTEREST, RSS Feed,

Email SMC: shemakescents@gmail.com

SMC Book Club: The Woman I Wanted to Be

Whenever you read a good book, somewhere in the world a door opens to allow in more light. – Vera Nazarian

I am an avid reader and every year I set out to read at least 12 books a year. It’s a resolution that when of making, seems simple. But yet, as the year goes on I find myself getting caught up in things that pull my focus away. That 12 book goal starts feeling like 1200 books. Last month, in a few moments of downtime, I took a pink post-it and made a list of books that I have been wanting to read. I then took it a step forward and bought the first book on my list. It was an autographed copy, at that! Afterward, I told my girlfriends from work who also seemed interested in some of the reads on my list and [insert angel choir here] the birth of the She Makes Cents Book Club was born. For the past month, I kept going back and forth about whether I would present it to the world as a monthly book suggestion, book review, or a book club and then I remembered about why I love books in the first place. Reading and discussing books with other people allows you to understand the same material, often time from a different point of view than one’s own. That is one of the things I miss about college… the ability to have an open dialogue about a multitude of subjects.

So Here Is How It Will Work:

Every month we will select a new book and announce that selection a week before the start of every month. This will give you time to go to your local bookstore, library, or download to your device. Selections for the books will come from readers suggestions and the list I started on the post-it. We ask that selections embrace powerful women, business cents, fictional favorites, and anything that informs and inspires us to be the people we aspire to be. With that being said, I am happy to announce the SMC Book Club: January Selection to be The Woman I Wanted to Be by Diane von Fürstenberg. I have always been a fan of her as a woman and I was so happy to see that she is exactly who I hoped her to be when watching her reality show “House of DVF”. This book explores the subject of her roots, love, beauty, and business; thus, making it the perfect choice for our January Selection. I hope you pick up the book and join the SMC team as we read our January selection. Discussions for this book can be found in the comments below starting Monday, January 5th.

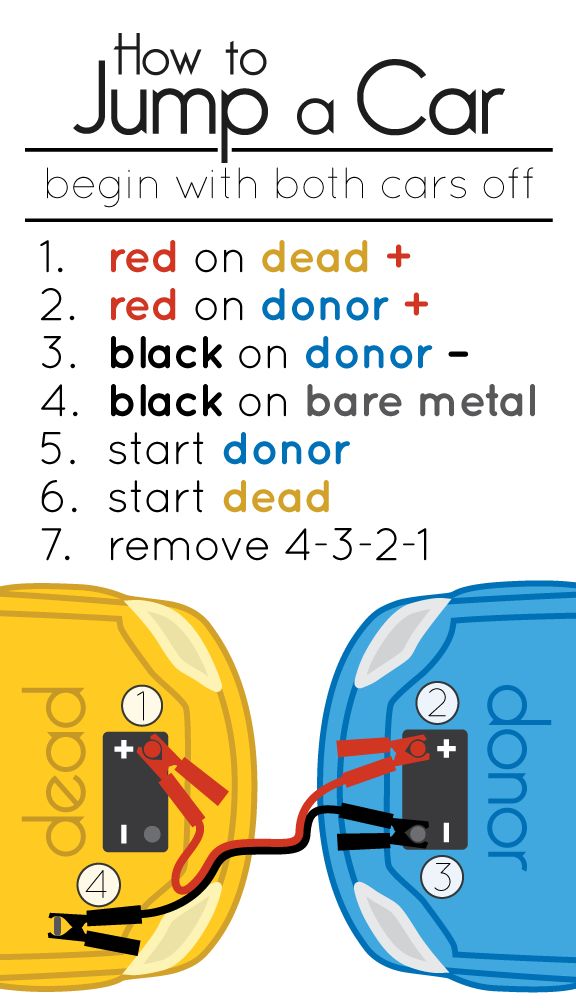

{Every Woman Should Know} How To Jump A Car

I had to learn how to “jump” a car out of necessity. It was a reactive skill because for months, my then new Mercedes C-Class had major battery drainage issues. Instead of being a damsel in distress, I became the type of woman who could jump a car in 4 ½ stilettos thanks to my Dad and the Mr. Let’s be honest, what’s the good in keeping jumper cables in your trunk for emergencies if you don’t know how to use them? I remember years ago having to jump my car from my friends Mercedes SUV. Her instinct was to call AAA because she was sure I was going to blow up her truck. We both drove off happy and inspired. I was happy to be on the road again and watching me doing it for myself inspired her because she had always depended on others in situations like.

Check out this super easy chart as a refresher for a skill “Every Woman Should Know

What Was The 1st Car You Ever Had?

FACEBOOK, TWITTER, PINTEREST, RSS Feed,

Email SMC: shemakescents@gmail.com

{Wise Words} Are You Attractive?

{50/20/30} Beginner’s Guide To Saving, Spending, & Living Life

I always say that every financial rules may not work for you and your financial situation. No one can tell you exactly what amount to save, what amount to spend, and how exactly you should invest; however, when people find something that works…you should find a way to make it work for you.

Three percentages that may change the way you live, spend, and save are the 50-20-30 rule, as explained by the good folks over at Forbes.

Check it out!

Let’s Get Social!

FACEBOOK, TWITTER, PINTEREST, RSS Feed,

Email SMC: shemakescents@gmail.com

Food For Thought: Finances & Job Security

Truth- There is nothing secure about job security. In fact, the emotional and physical stress that people experience over worry of losing a job and not being able to keep up a lifestyle or provide for a family is all too common. According to this article from the Wall Street Journal, “As many as two-thirds of people in the U.S. don’t have the recommended six months of expenses saved. The percentage of people with savings enough to cover at least three months shrank to 40 % in 2014, compared with 45%, a year earlier.”

So when do you make a plan for the worst? Well, it’s better to have one in place before you need it…and I hope you will never need it. Having the recommended six months of expenses is just that- a recommendation. You have to figure out what amount works best for you and if you are like me, having a goal and a plan to get more than the recommended amount would put my mind at ease, since it can still take more than six months to secure a new place on your career path. The good news is, it is never too late to start protecting yourself financially. Are you saving enough? If not, don’t undercut yourself by saving a little this week and skipping next week. Get in the habit of paying yourself first! You owe it to yourself and those you support to be financially secure in a world where job security isn’t secure.

Companies are downsizing, departments are being eliminated, and employers are trimming the fat. If you lost your job today, how long would you be able to survive financially?

FACEBOOK, TWITTER, PINTEREST, RSS Feed,

Email SMC: shemakescents@gmail.com

Credit by ExtraMadness.com

Beginner’s Guide to: Understanding Financial Terms

As a millennial woman, I know many of my peers shy away from conversations about money and becoming financially fit for fear of looking dumb for not knowing the basics. Financial terms are spoken and we hear Charlie Brown’s teacher and stop listening. I want to help break down self-imposed barriers that could be keeping us from confidently making smart money moves. In an interview for Mint, I was asked off the record if I thought that women view money management differently than men. While some people believe women are not confident in making big financial decisions, I’m inclined to disagree.

As a millennial woman, I know many of my peers shy away from conversations about money and becoming financially fit for fear of looking dumb for not knowing the basics. Financial terms are spoken and we hear Charlie Brown’s teacher and stop listening. I want to help break down self-imposed barriers that could be keeping us from confidently making smart money moves. In an interview for Mint, I was asked off the record if I thought that women view money management differently than men. While some people believe women are not confident in making big financial decisions, I’m inclined to disagree.

When armed with the proper tools to make sound financial choices, women prove to be confident, powerful, and commanding in their financial choices.

Every week, She Makes Cents will introduce a financial term with hopes to empower you to expand your financial literacy. For some this is a refresher and for others, it may be the first time that you understand, what these terms mean and how they affect YOUR money. Either way, you are arming yourself to take the lead in your own financial situation and achieve the goal of living the fabulous life while being financially savvy!

If there is a financial term you want explained, shoot us an email and we will answer it on the site. Stay tuned tomorrow when we talk investments and returns.

Let’s Get Social!

FACEBOOK, TWITTER, PINTEREST, RSS Feed,

Email SMC: shemakescents@gmail.com