The government or more specifically the Consumer Financial Protection Bureau (CFPB) filed a lawsuit against Navient, the nation’s largest student loan service provider last week. Navient is the twin sister to the head of the student loan mafia, Sallie Mae, Inc. that services the loans of more than 12 million borrowers, including my own. As a loan service provider, they manage borrowers’ accounts, process monthly payments, and communicate directly with borrowers. The suit was filed on January 18th with another following just days before the transition of presidential power.

According to the CFPB Director, Richard Cordray, “Navient chose to shortcut and deceive consumers to save on operating costs. Too many borrowers paid more for their loans because Navient illegally cheated them and today’s action seeks to hold them accountable.” Some of the most pressing allegations include failing to correctly apply or allocate borrower payments to their accounts, steering struggling borrowers toward paying more than they have to on loans, obscured information consumers needed to maintain their lower payments and deceived private student loan borrowers about requirements to release their co-signer from the loan.

What That Means for You?

If this lawsuit is successful, consumers affected by Navient’s alleged misdoings may receive some monetary restitution. Don’t get too excited yet. This is not a class-action suit that you can sign up for. According to ClassAction.org, “Attorneys usually find out those who were affected by looking at the defendant’s records in a phase of the litigation known as the discovery phase. People who could be covered by the suit are usually sent a notice or check in the mail. The agency that filed the lawsuit will also have information on their website about the suit and who can claim money in the event of a settlement”.

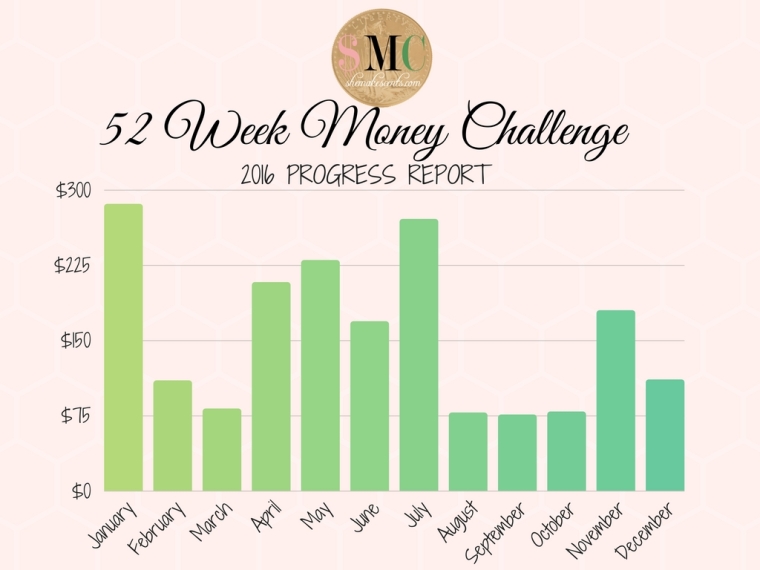

Happy Friday #SMCmoneytribe. I am coming to you on week two of the She Makes Cents Money Challenge to talk about the subject of motivation. I imagine most people join this challenge for one major reason; they want their future financial situation to be better than their current circumstances. This can be with respect to a very specific goal, such as saving for vacation or it could simply be the catalyst to fostering better saving habits like starting an emergency fund. Either way, you accepted the challenge and are in it to win it, so I ask you…what keeps you motivated?

Happy Friday #SMCmoneytribe. I am coming to you on week two of the She Makes Cents Money Challenge to talk about the subject of motivation. I imagine most people join this challenge for one major reason; they want their future financial situation to be better than their current circumstances. This can be with respect to a very specific goal, such as saving for vacation or it could simply be the catalyst to fostering better saving habits like starting an emergency fund. Either way, you accepted the challenge and are in it to win it, so I ask you…what keeps you motivated?

I pose this question every year and 2017 is no different. What one word reflects your vision for 2017? So many of you submitted thoughtful responses via the

I pose this question every year and 2017 is no different. What one word reflects your vision for 2017? So many of you submitted thoughtful responses via the  Four years ago was my year of BALANCE, 2014 was my year of FOCUS, 2015 was my year of PASSION, 2016 was my year of BRAVERY, and I welcome my year of INTENTION. I am working very hard to make sure that my words and actions are in line with the following criteria: Is it kind? Is it necessary? Is it truthful? As each year passes, I take a moment and reflect on why I chose my earlier words, where I was in my personal development for that to be a necessary focus, and how I incorporated the meaning of those words in my life.

Four years ago was my year of BALANCE, 2014 was my year of FOCUS, 2015 was my year of PASSION, 2016 was my year of BRAVERY, and I welcome my year of INTENTION. I am working very hard to make sure that my words and actions are in line with the following criteria: Is it kind? Is it necessary? Is it truthful? As each year passes, I take a moment and reflect on why I chose my earlier words, where I was in my personal development for that to be a necessary focus, and how I incorporated the meaning of those words in my life.